2025 Foreign Material Contamination in Food

BENCHMARK REPORT

Table of Contents

Introduction & Methodology

Foreign material contamination—the physical contamination of food, beverages, and other products by materials not common to the product—is the third-largest cause of recalls in the food industry. This annual survey is intended to be a resource that gives manufacturers insight into the strengths and weaknesses of various approaches taken by industry peers, with the goal of reducing the impact of foreign material incidents in the food industry.

Foreign material comes from every part of the supply chain, from raw ingredients in the field to the packaging machines on the plant floor and various points in between. These incidents can stem from supply chain relationships, aging equipment, or the result of a simple employee accident or oversight. Managing this wide array of sources is a challenge; preventing future incidents is more challenging still.

This report presents findings from our second annual benchmark survey on the challenges and management of foreign material contamination. It presents data from a June 2025 survey of over 160 industry professionals across a wide range of industries, representing 34 U.S. States and 3 international producers.

Our goals in producing this annual benchmark report are twofold:

- To provide food safety professionals with a deeper understanding of the scope of the foreign material challenges in the food and beverage industry

- To provide annual benchmarks around how food and beverage producers manage and solve foreign material incidents

To view our 2024 Benchmark Report, click here.

Key Findings

Key Finding: Proactive vs. Reactive Approaches to Foreign Material Control

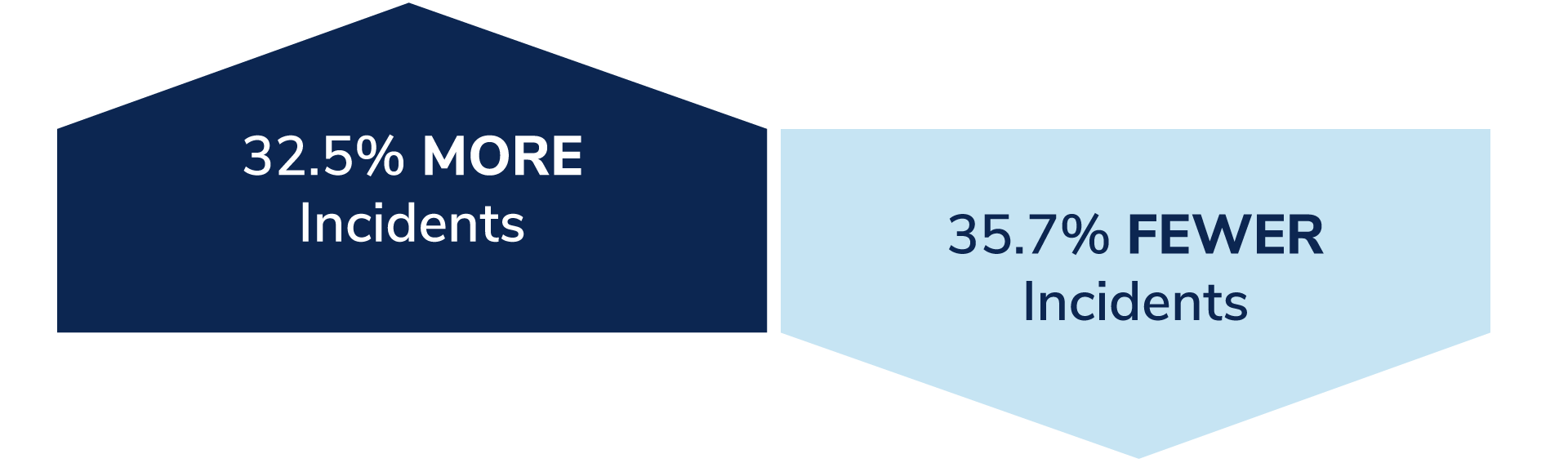

This year’s survey asked respondents if they had observed an increase or decrease in foreign material incidents — and why they believed those increases or decreases took place.

Proactive Responses → Fewer Foreign Material Incidents

Responses varied, but analysis of the actions producers took and the correlation to outcomes in frequency of foreign material incidents yielded interesting findings.

- Producers who took proactive measures often saw improving results.

- Producers who took reactive steps often saw declining results.

There are a few influences that appear in both groups. In these cases, how the producer in question implemented the change appeared to have more effect on the outcome than if the producer implemented the change.

Internal Processes – Execution-Dependent

As a source of decreased foreign material incidents, process improvements were among the most common responses, including everything from the use of corrective action plans to changes in inspection frequency.

Detection Technology – Execution-Dependent

The 35% of respondents who experienced a decrease in foreign material incidents typically added inline systems like sieves, strainers, magnets and some in-line X-ray designed to “catch” foreign material before it became a full-scale incident.

Preventative Maintenance

Producers who took steps to improve their preventative maintenance plans saw a decrease in incidents of foreign material. An example might be increased use of X-ray detectable components for equipment repair and conditioning, or increasing checks on parts ahead of their mean time to failure.

Supplier Relationships

Supplier monitoring and validation programs can help to limit the introduction of foreign material in ingredient inputs while also strengthening trust in supplier relationships. Producers who executed these programs saw suppliers become more focused on adherence to Foreign Material Specifications, similar to requirements around microbiological, chemical or qualitative specifications.

Root Cause Analysis

Several respondents outlined how they adhere to a practice of root cause analysis when dealing with foreign material—and more importantly, how they turn that root cause analysis into iterative improvement at their facility.

Leadership Engagement

While all of these measures to reduce foreign material introduction play a factor, respondents who saw improvement specifically mentioned the engagement of their leadership team as key drivers of organizational change.

Food Safety Culture – Execution-Dependent

Responses that mentioned culture in relation to decreased foreign material incidents specifically mentioned better communication, awareness, and team collaboration.

Reactive Responses → Greater Foreign Material Incidents

The causes cited for an increase in foreign material contamination incidents can be classified as primarily reactive.

Aging Equipment

Among respondents citing an increase (~40%) in foreign material contamination incidents, aging equipment was a common response as both a contributor of foreign material (broken gaskets, equipment as foreign material) and a cause of missed detection of foreign material (inconsistent or miscalibrated equipment).

Poor Preventative Maintenance

In a similar vein, respondents with an increase in incidents cited “poor” or “failing” preventative maintenance programs as a cause, with some respondents citing specific points of frequent failure (e.g., decreased quality of gasket material, aging pumps) as issues generated by aging equipment that preventative maintenance could have corrected.

New Employees

The topic of turnover in the manufacturing workforce has been one of exhaustive study, and one that was noted as a cause of increases in foreign material incidents. Respondents cited new employees with little to no experience in food production as a significant source of foreign material increases.

Suppliers

Nearly 50% of respondents in this group reference foreign material introduced upstream in the supply chain, but did not make mention of programs in place to address those issues—highlighting the need for enhanced supplier monitoring programs.

Several respondents observed more foreign material as the result of supply chain partners expanding to new fields and facilities to meet greater demand for ingredients, which is likely a point of interest for producers across sectors as they look to put checks and balances in place during their due diligence checks of new partners or changes to existing partners’ capacities.

Food Safety Culture – Execution-Dependent

When cited as a source of increased foreign material incidents, culture-focused responses reflect poor food safety culture: decreased inspections leading to less incidents, specific misalignment with leadership on effective manufacturing practices, and sparse monitoring.

Internal Processes – Execution-Dependent

Processes contributed to increased foreign material incidents through changes in production protocols for business reasons (increased processing leading to greater incidents) or process improvements that effectively identified more foreign material incidents in production.

Detection Technology – Execution-Dependent

Those who experienced an increase simply cited “new equipment” as the cause, which may be related to the same additions noted above as they are finding materials they previously would not.

What Does This Mean for Producers?

The producers who saw the most measurable improvements in the remediation of foreign material contamination incidents are taking a proactive, multi-faceted approach that includes everything from increased training and process enhancements to the implementation of advanced detection technologies.

For producers who saw the opposite results, it’s important to understand and advocate for the necessity of the proactive remediation approaches outlined above.

Across the board, producers should understand that progress in dealing with foreign material contamination is not a straight line. There is a subset that appears in the groups above that saw an increase in foreign material incidents because they added more equipment to their production lines—in this case, an increase in incidents is likely a good thing, as it means their detection equipment is doing its job, flagging foreign materials.

A short-term increase in foreign material incidents can set the stage for long-term, permanent improvement, provided you take an honest look at your foreign material reduction maturity and plan realistic measures to improve.

Key Finding: Producers Increase Investment in Detection Technology, But It’s Not a Silver Bullet

Of those surveyed, nearly 70% said they planned to make at least some investment in in-line detection technology in the next 3 years, with one-quarter of that group planning more significant investments in in-line detection technology. Only 30% said they plan to maintain their in-line detection technology levels.

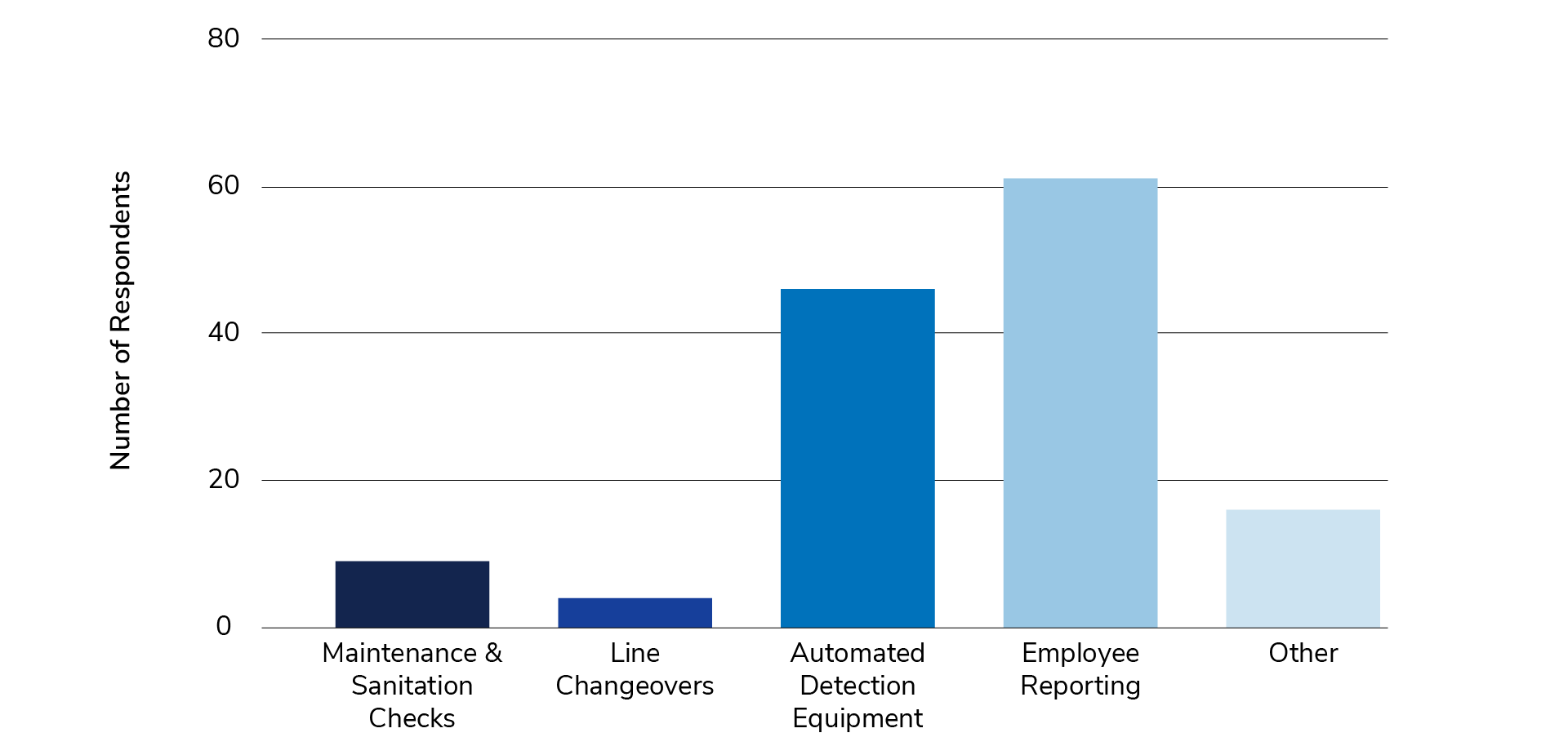

This result isn’t surprising. The level of investment in technologies that protect food from all types of contaminants has only grown since the introduction of mass-production manufacturing practices. What is surprising is who—not what—respondents identified as the most common identifier of a potential foreign material contamination issue: humans.

Human Intervention Continues to Play a Key Role in Preventing Foreign Material from Entering Commerce

Make no mistake—automated detection systems are a revelation compared to past approaches, but employee reporting is still the top response in 2025, particularly when adding scheduled checks and line changeovers.

What Does This Mean for Producers?

There is no single solution for foreign material contamination challenges—not even the best technology. The best mitigation of foreign material contamination—both in catching problems before they make it into commerce and for catching contamination before it ends up in finished, packaged product—is a confluence of the best-fit technology for your product, a strong supplier evaluation program, a strong internal food safety culture and humans who understand both the risks and how to mitigate them after a potential event is discovered.

Key Finding : A Need For Greater Focus on Training & Understanding

It’s also worth noting the observed inconsistency in producers’ overall understanding of foreign material and the best practices for addressing related challenges.

53% of respondents said they investigate after a single automated rejection from detection equipment, yet only 19% are “very confident” that their in-line technologies are finding all incidents of foreign material.

While one could argue that investigating every rejection is unrealistic in light of the confidence in technology, it stands to reason based on producers’ responses that the inverse is true: while there are false rejects, every automatic rejection could be an opportunity to investigate root causes upstream and improve performance around foreign material.

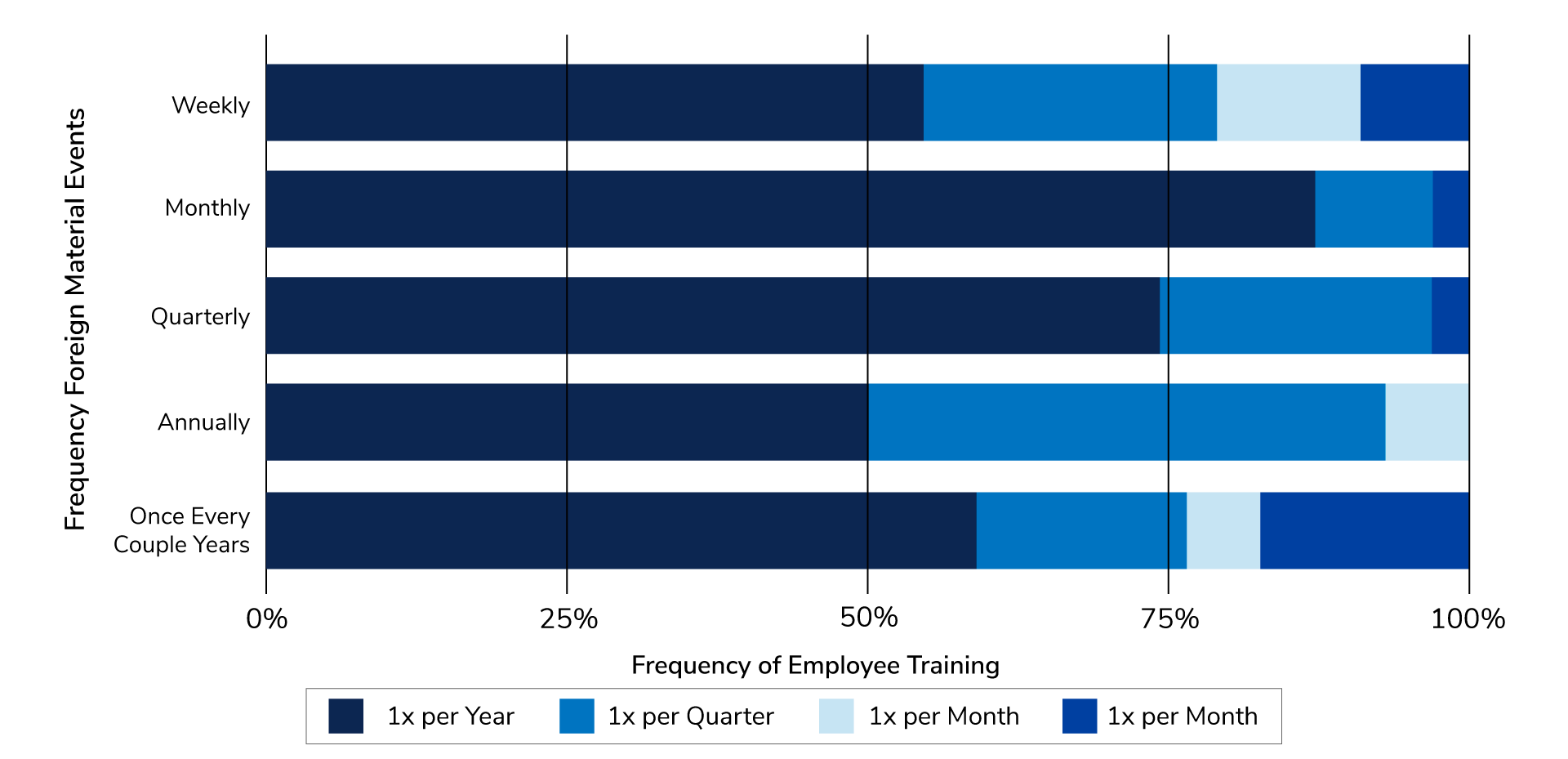

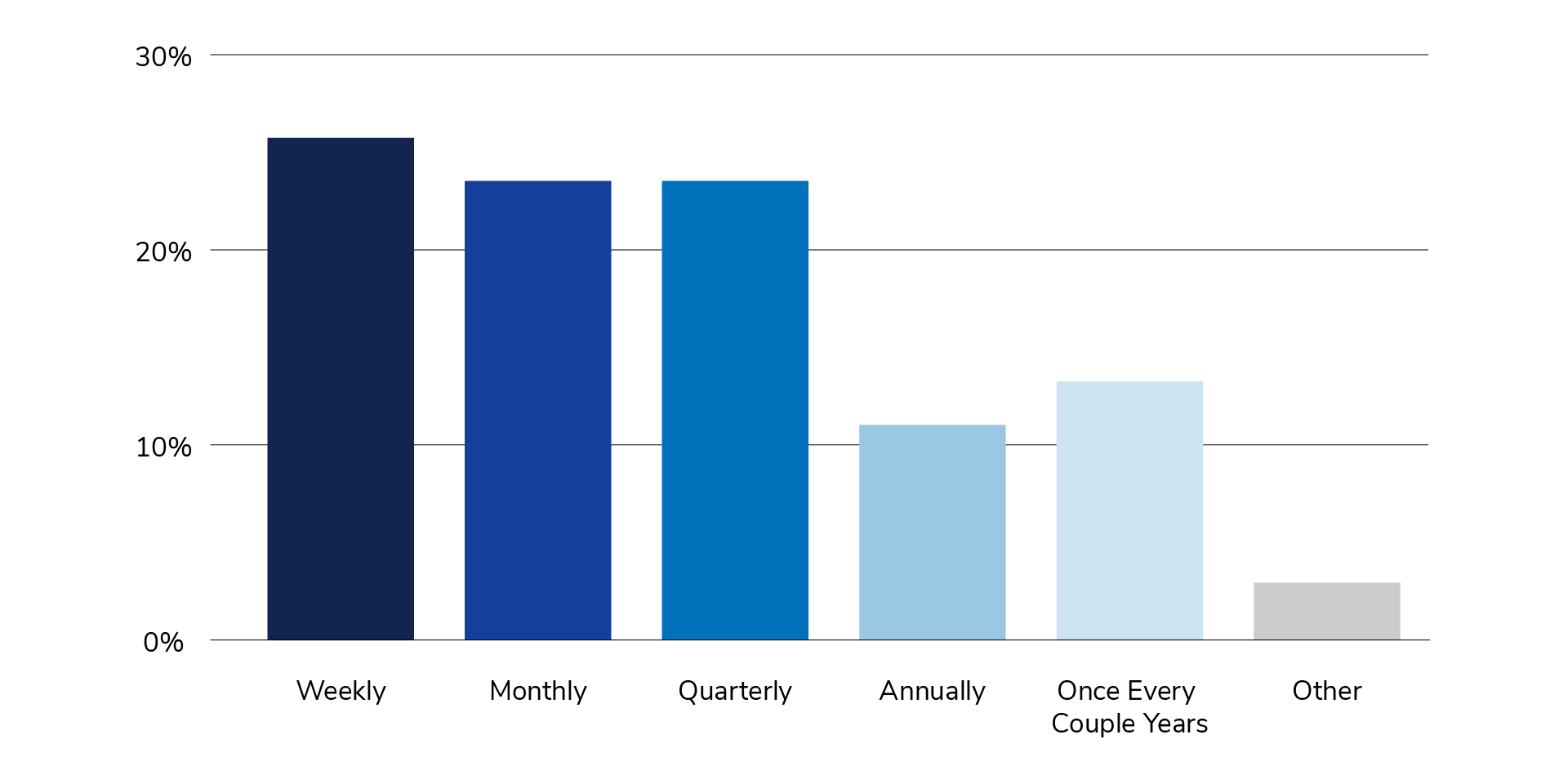

67% of respondents train employees just once per year on foreign material, yet 45% said employees are the strongest identifier for foreign material contamination.

Ongoing training and skills development around foreign material contamination is a high-value activity that happens less often than it likely should. This is not necessarily about PowerPoint slides in a training room—there are real, practical techniques for training and reinforcing employees, like:

- Recognition programs to positively reinforce reporting potential issues

- Food safety scorecards to improve visibility to outcomes

- Increase training frequency to offset worker turnover or promotion

- Boxes on plant floor to put misplaced tools and parts when found

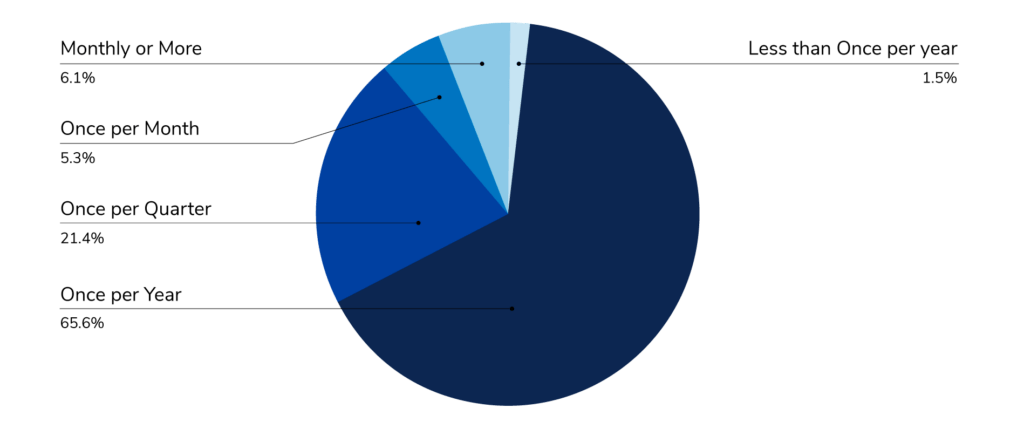

Data comparing the frequency of training staff on foreign material contamination when compared with the frequency with which producers encounter incidents indicates at least some correlation:

Foreign Material Events x Employee Training

What Does This Mean for Producers?

Regularly training employees on foreign material is a considerable investment, and context matters. Many times, a higher training frequency may not be operationally or financially possible.

Full Survey Results

Frequency of Foreign Material Events

On average, how frequently do you have foreign material contamination events in your facility?

The overwhelming majority (73%) of respondents in this year’s benchmark encounter foreign material incidents multiple times per year, with nearly half experiencing foreign material events on a monthly basis.

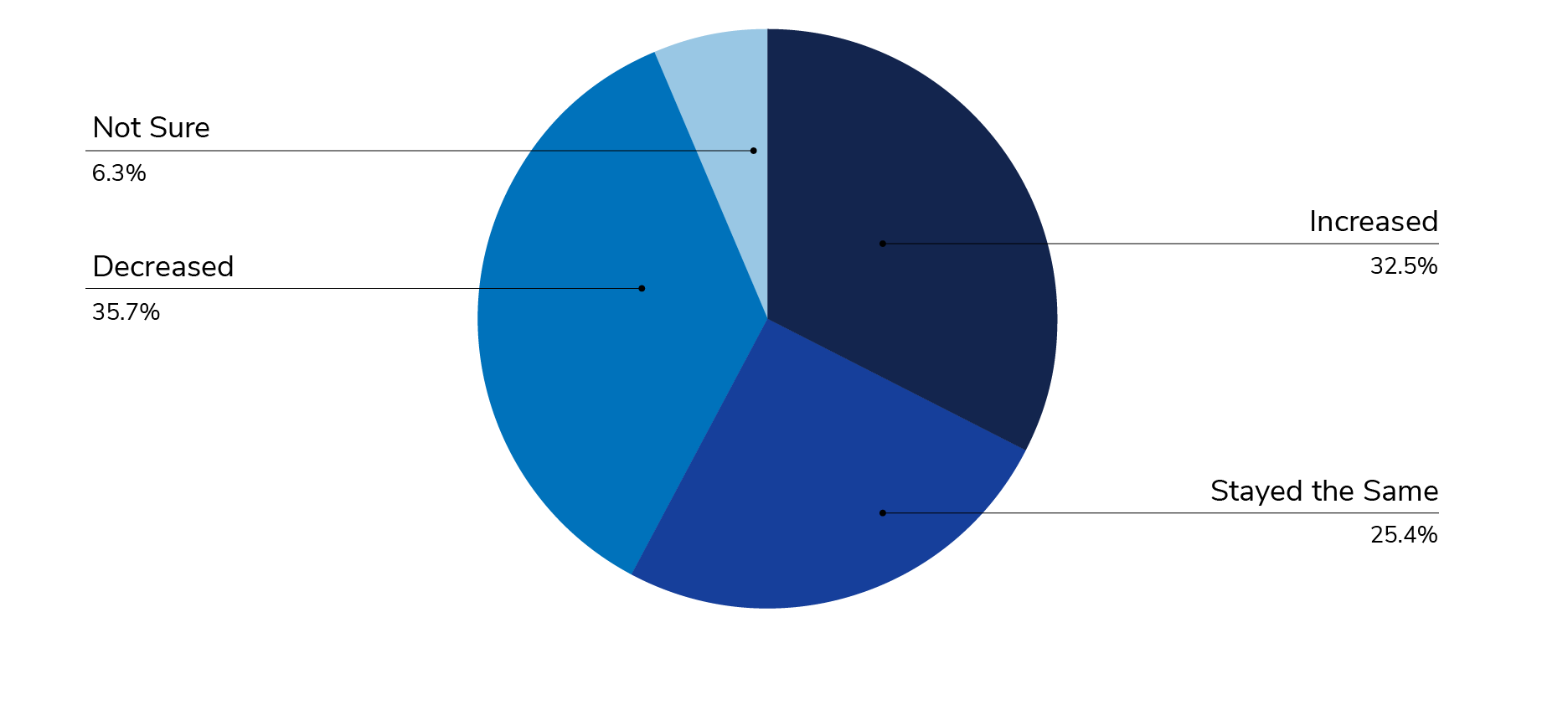

Change In Frequency of Foreign Material Events

How has the frequency of foreign material contamination events in your facility changed in the past year?

Just over one-third of respondents saw improvement in their foreign material contamination track record over the last year. Foreign material remains a challenging problem to solve, and even with investments in additional technology, producers haven’t implemented solutions that have led to improvements in the overall frequency.

Industry Breakout: Frozen Food, Protein, RTE

The influence of these market segments on the whole average is plain in the graph, as is the marked improvement these segments have made over the last year. While the margin of error is wide at these sample sizes, these industry verticals have historically dealt with more foreign material contamination events than other industries, and their maturity in developing solutions for physical contamination outstrips their counterparts in other spaces.

Industry Breakout: Snack, Dairy, Produce

In contrast to Protein/RTE/Frozen, a handful of industries have seen an outsized increase in the frequency of their foreign material incidents in the last year, namely Snack Foods, Dairy and Fruits/Vegetables.

While slight, these responses tend to indicate that snack foods, dairy, and fruits & vegetables are behind the maturity curve in their handling of physical contamination. This is supported by nearly all of the “Unsure” responses coming from these industries. Fruits and vegetables are a definite source of physical contamination, often of the natural variety. There isn’t a strong explanation for why snack foods are in this group.

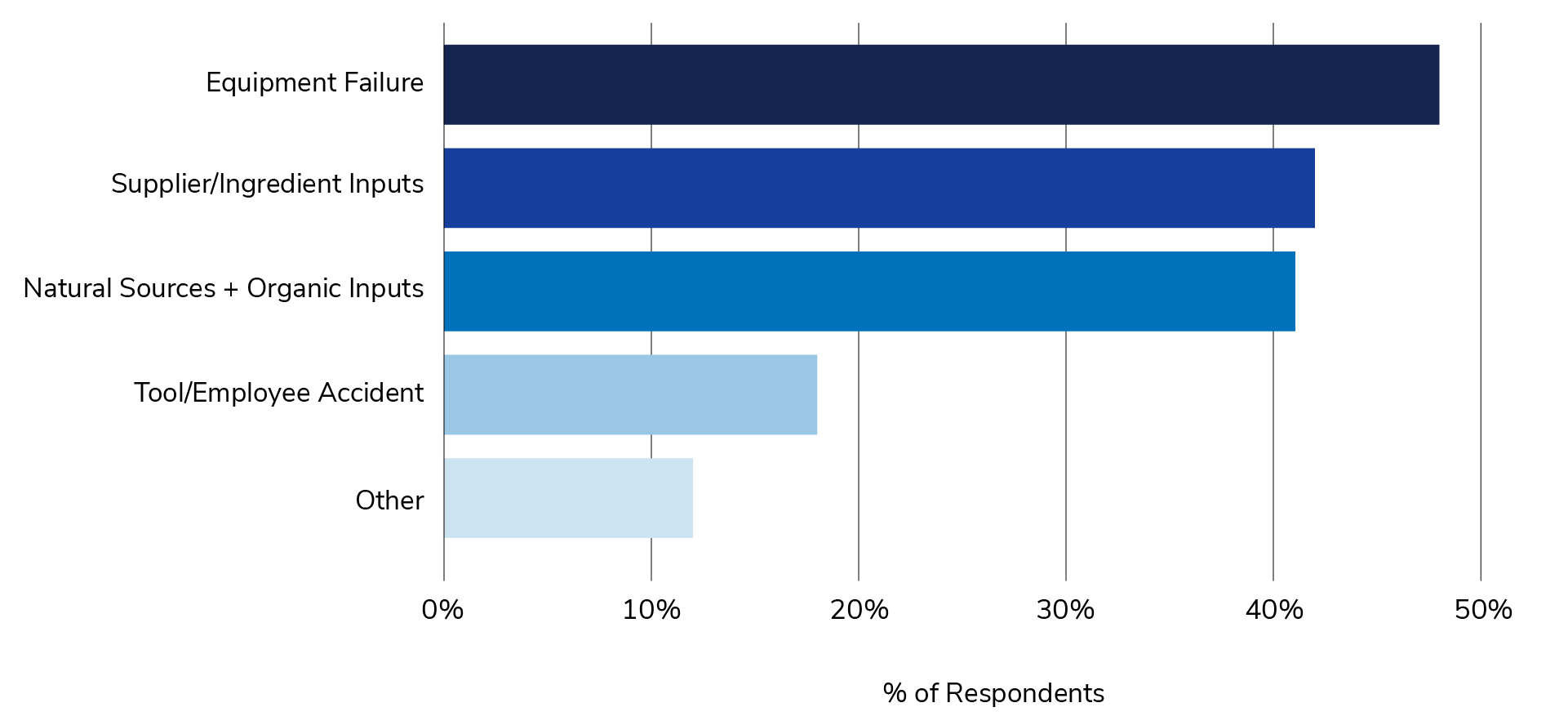

Sources of Foreign Material Events

What are your most common sources of foreign material contamination—select up to two options:

Equipment Failure

Equipment failure is the top cause of foreign material contamination for producers. The main reporters of equipment failure were in segments that typically use a broader array of processing and production equipment: protein, RTE, baked goods, and snack foods. These heavily processed, often packaged products encounter more equipment at risk of failure than their counterparts in other industries.

Interestingly, frozen foods were split in this response—their leading contributors were a split between equipment failure and supplier inputs.

The prevalence of improved preventative maintenance programs as a cause of decreased foreign material contamination bears repeating here.

Supply Chain

While equipment failure was the largest single contributor in the responses to this question, the combination of supplier/ingredient inputs, natural sources, and organic materials from input ingredients makes the supply chain the biggest overall source of foreign material.

There are a variety of preventative actions producers are taking specifically to combat this, including:

- Utilizing third-party audit services

- Developing supplier programs that include foreign material specifications

- Auditing supplier ingredients

- Working with suppliers to develop their standards

- Supplier surveillance and/or validation programs

Helpful Definitions

Supplier / Ingredient Inputs

Contaminants from the facility of an upstream supply chain member, including within one’s organization.

Natural Sources

Naturally-occurring contaminants (stone, wood) that are not part of the original ingredient.

Organic Material from Input Ingredients

Naturally-occurring contaminants (i.e. bone) that are part of the original ingredient.

Signal Frequency of Foreign Material Events

What is your most common signal that you have a potential foreign material event?

This topic has been thoroughly covered in the key findings section of this report, but it’s worth repeating that employee reporting is the top ‘signal’ of a potential foreign material incident within the majority of organizations. This group is followed by a large segment that relies on equipment, which is to be expected.

One notable and negative trend in this data: the majority of respondents in the “Other” segment listed “Customer Complaint” as their most common signal for a foreign material event. While some of these same respondents encounter foreign material with relative infrequency (quarterly or annually), the customers driving their top signals may have limited training, poor reliability in reporting and inconsistency in how they should address foreign material incidents.

Signal Threshold of Foreign Material Events

What is the threshold from automated detection equipment for you to conduct an upstream root cause investigation?

There is nuance to responses for this question based on what the respondent is producing, but this was one of the bigger surprises in this year’s survey. Just over half of respondents are investigating after a single rejection, which may speak to the need for additional fine-tuning around automated detection equipment to increase confidence in results.

Detection Equipment for Foreign Material

What types of in-line detection or prevention equipment do you include in your operations? Choose all that apply.

Insights

- Metal Detectors remain the top resource for in-line detection, though this raises questions and concerns about both (1) non-metallic types of foreign material contamination and (2) non-ferrous metals that enter product streams. Metal detectors are clearly useful, but they are not an effective tool for every contaminant type.

- Sieves & Screens are the second-largest group, outpacing X-ray by just over 6%. Challenges here include finding foreign material of smaller sizes.

- X-ray has better adoption than before, but it is still significantly behind metal detection. In verbatim responses, many respondents cited X-ray as an ‘advanced technology’ they are looking to implement in the near future, showing that adoption of X-ray is still not standard in the industry.

Equipment Investment for Foreign Material

How do you plan to change your level of investment in in-line foreign material detection equipment within the next three years?

Insights

- ~70% of producers are planning an increase in detection equipment in the next three years, with more than one-fifth of that same group planning large investments.

- 30% of producers plan to keep their detection equipment the same over the next three years.

Within this set of questions, producers were asked to detail their plans for different types of technology investments, which are listed in order of frequency below:

X-Ray Technology Dominates

The most frequently mentioned technology for investment was x-ray, largely driven by requirements of customers, packaging applications and enhanced detection capabilities.

AI & Vision Systems Gaining Traction

The growth and development of AI systems for use at scale over the last decade has enabled producers to invest in relatively new camera-based, AI-learning driven inspection technologies for automated detection and quality control.

Metal Detector Upgrades

Most producers looking at this industry-standard technology are working to replace outdated units with newer units. Some are looking at ‘positive discharge’ systems, while others are hoping to improve sensitivity for aluminum detection.

Optical and Sorting Technologies

Specialized solutions that utilize hyperspectral imaging, color sorters and optical inspection systems can help mitigate risks, but only for specific and visible contaminant types.

In-Line Equipment Confidence in Foreign Material Detection

How confident are you that your current in-line detection equipment is finding all foreign material in your product?

Insights

Confidence dropped compared to data from 2024. There is not a clear explanation for, but potential causes could include:

- A major equipment failure in the last year

- A major recall in the last year

- Better education about equipment capabilities and calibration needs

On a positive note, the “Somewhat Confident” group is likely appropriately wary—equipment can be a source of foreign material, including foreign material sources that in-line detection equipment isn’t calibrated to detect, like rubber or aluminum.

Confidence in Equipment and Future Equipment Plans

Insights

- The group planning the largest increase in equipment is the group with the least confidence in their existing equipment.

- Even among those that are very confident in their current equipment, plans to increase equipment outnumber plans to stay with current systems.

- Respondents who said they were somewhat unconfident in their equipment were out of step with the overall trend, as they reflected lower planned future investment in technology than their counterparts.

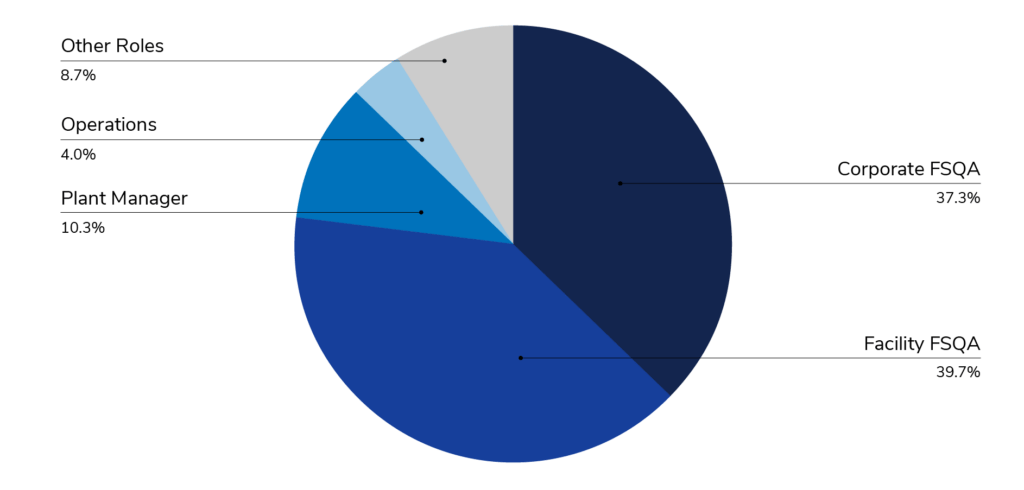

Key Decision Makers for Foreign Material Holds

What roles are involved in initial discussions on how to disposition product on-hold for foreign material contamination?

Who ultimately has decision-making authority over what to do with contaminated or on-hold product at your facility?

FSQA remains the lead when it comes to foreign material, but the decision making process is heavily influenced by corporate policy and decision making. This highlights the growing trend of collaborative, cross-functional decision-making that helps alleviate some of the problems foreign material can pose, particularly those around institutional knowledge drains.

How frequently do you train staff on foreign material prevention and awareness?

The vast majority of respondents are training staff once per year, which aligns with guidance from the FDA. As outlined in the key findings, there is a rough correlation between these responses and the frequency with which foreign material contamination occurs. Respondents who indicated a reduction in foreign material incidents frequently cited better training and awareness as direct causes of better outcomes.

Top Considerations in Determining Solutions for Foreign Material

Respondents were asked to rank their top three considerations when determining what to do with potentially contaminated product. Options included:

- Capability of internal technology to find contaminants

- Cost of reworking affected product in your facility

- Adherence to internal HACCP standards

- Opportunity cost of inspecting affected product

- How quickly we are able to re-inspect/re-work product

- Brand impact from potentially contaminated product in market

- Food waste reduction/sustainability targets

The assumption of this question is that FSQA managers, by nature, prioritize the strategic goal of consumer safety above all else. Accepting that as a given, here is a visualization of the responses:

How to Read This Sankey Chart

All respondents are represented at left. From there, they split into the seven responses according to the number of respondents who selected that as their first consideration. Between the second and third, third and fourth groups, the chart shows the complex way in which producers’ considerations change when moving to their second or third preferences.

Overall, there are some consistent trends at work:

- Cost considerations, both in terms of the cost of rework and the opportunity cost of inspecting the affected product, are the dominant concerns for producers.

- Operational considerations (speed, technology) are the second largest group of concerns for producers and have a lot of interchange with the cost considerations, particularly between first and second priorities.

- HACCP Standards are a larger group than expected, ranking as the #4 top consideration, #2 second consideration, and #1 third consideration.

- Brand and sustainability concerns are distant considerations in these evaluations—but when they are concerns, they have greater than expected crossover with one another. In other words, companies concerned with brand reputation seem more likely to have concerns around sustainability.

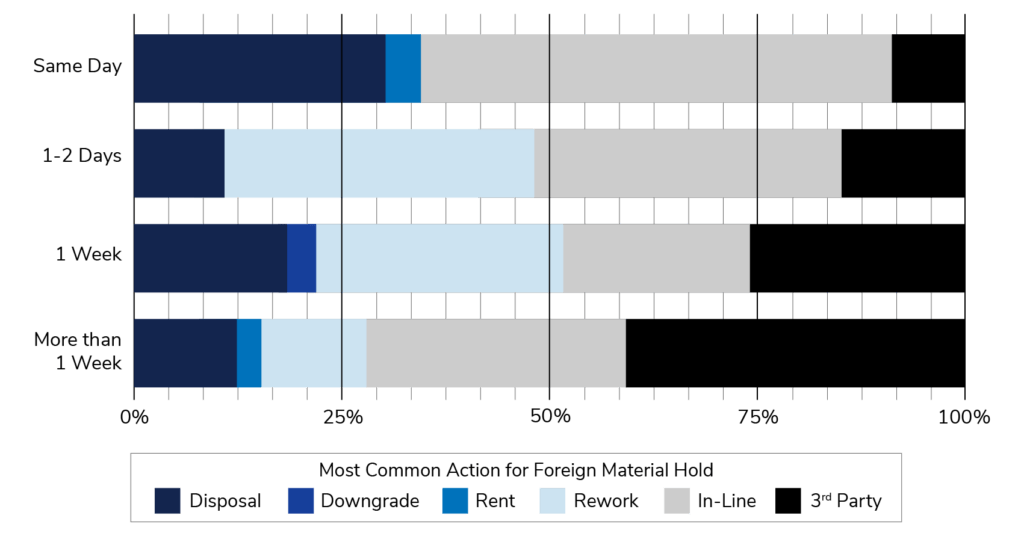

Most Common Action for Foreign Material Holds

What is the most common action that your facility takes when faced with a product hold due to potential foreign material?

Insights

The majority of respondents use their own resources to deal with contaminated products, with a full one-third of respondents using in-line or in-house resources to solve these issues. That said, it is incumbent that industry experts work with manufacturers to understand the drawbacks of doing the same inspection over again (potentially missed contaminants) and the expectations that internal rework is enhancing their overall program. Almost one-fifth of producers are disposing of contaminated product, with very few respondents using alternative methods like downgrading product or renting additional in-line equipment.

How long does it usually take your organization to clear a hold for potential foreign material using in-house resources?

Insights

Respondents who could clear a hold within forty-eight hours (same day, 1-2 days) and respondents who needed a week or more were nearly equal in size, though their common action steps diverged significantly. Those in the “other” category typically responded that context impacts how long it takes for them to clear a hold, but time estimates ranged from days to weeks—or contextual use of third-party inspection.

What does this mean for producers?

Time to Resolution x Most Common Decision Making

Insights

- Producers that can clear holds the same day still use disposal about half as often as they leverage in-house resources.

- Producers that need longer than a week to clear holds are the most likely to utilize third-party inspection resources.

- Producers at the one-week mark show the widest variety of actions taken.

Concluding Data & Takeaways

There is much in this year’s benchmark report that should be of interest to FSQA professionals seeking better outcomes around foreign material contamination:

- Taking proactive measures is shown to help address problems at root causes instead of focusing only on external factors

- Training is a vital component of foreign material reduction for food producers – but there is still is a knowledge gap that needs to be addressed

- There is a clear emphasis on investment in detection equipment across a range of industries

Final Observations

Too many companies are still trying to do this on their own. While there are some cases where in-house resolution might be the most economical option, the most effective, proactive option—and the one that has helped producers find and trace more foreign material problems than any other while reducing product waste—is third-party inspection.

A trusted partner can help validate the scope of a foreign material contamination event, report on the affected product, and even help with retrieving foreign material for further analysis in your lab or through a lab partner. These are all key parts of gathering the relevant data for making an informed food safety disposition – and preventing future incidents from occurring through careful root case analysis. Through our investments in superior technology and personnel familiar with food safety requirements, FlexXray is committed to providing the industry with better solutions for foreign material contamination.

If you’d like to learn more about how third-party inspection can help you find the right balance among your cost, technology, compliance and brand expectations—call FlexXray today.