2024 Physical Contamination in Food

BENCHMARK REPORT

Across the organizational layers of food and beverage manufacturing, food quality and safety leaders confront more complex issues than ever before. The regulatory environment, rising consumer transparency, sustainability initiatives, labor costs, and increasing automation all contribute to an environment where maintaining food safety standards is ever more challenging — and always in the spotlight.

Physical foreign material in food is the unintended consequence of the industry’s production methodologies—and, in some cases, supplier challenges—which have created the greatest variety of products ever brought to the consumer. Faster production speeds, increased automation, supplier diversity, and increasingly complex operations have led to more frequent discovery of foreign material in food products.

The irregular, unique hazards of physical foreign material contamination—and the lack of proactive preventative or ameliorative strategies for them—make their resolution challenging for FSQA experts.

Our goals in developing this report are:

- To provide food safety professionals with a deeper understanding of the scope of the foreign material challenges in the food and beverage industry

- To provide benchmarks around the management and solutions of foreign material incidents

The following report represents our first-ever benchmark report on the challenge and management of foreign material contamination in food. It presents data from a February 2024 survey of over 200 industry professionals across a wide range of industries and representing 37 U.S States and 1 Canadian province.

Key Findings

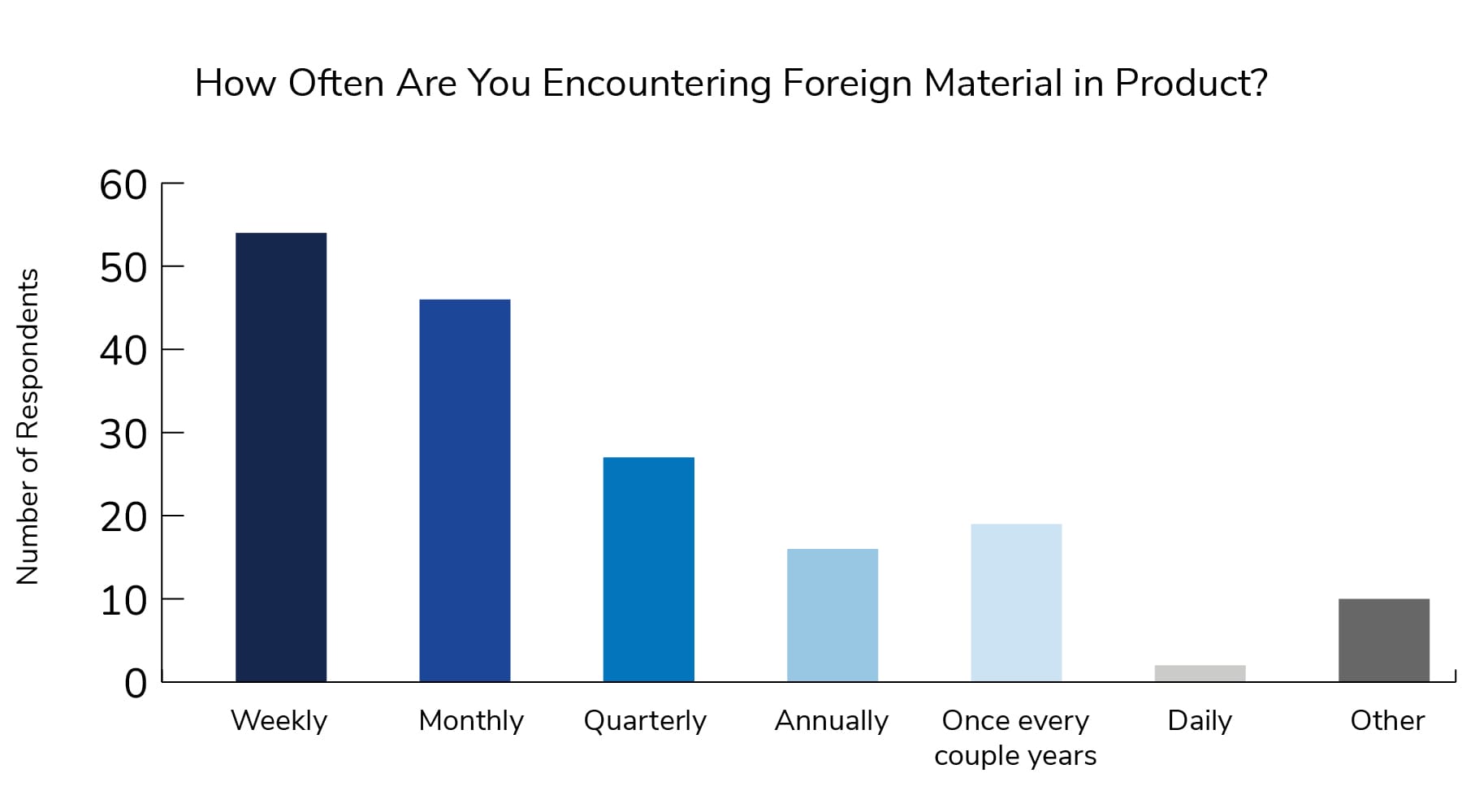

Key Finding One: The Frequency of Physical Contamination

Takeaway:

While the issue of physical contamination is irregular in timing, it is decidedly not irregular in frequency. Food and beverage producers face this issue on a near-constant basis. In 2023, there were 71 recalls issued related to foreign material contamination.

Even accounting for some margin of error in the reported frequency of foreign material on the producer side and for underreported foreign material in food product resulting in a recall on the consumer side, producers are discovering physical contamination before it hits store shelves—but how they are each dealing with it is another story.

Key Finding Two: Understanding The True Cost of Rework Is A Major Issue

59%

of respondents reported that in-house resources are used as the most common foreign material contamination remediation tool.

Takeaway:

In several contexts within our survey, the most common tools producers are using to resolve physical contamination issues are those they have on hand, with a time/cost-benefit analysis frequently leading them to this option. Depending on the scale of the foreign material hold, this may make sense.

However, with the growth in the cost of internal labor, line downtime and the outstanding question of whether internal resources and inline X-Ray can find the foreign material embedded in product, our experience working with customers to ensure that the cost-benefit analysis works in their favor suggests this number should be closer to ⅓ than it is to ⅔.

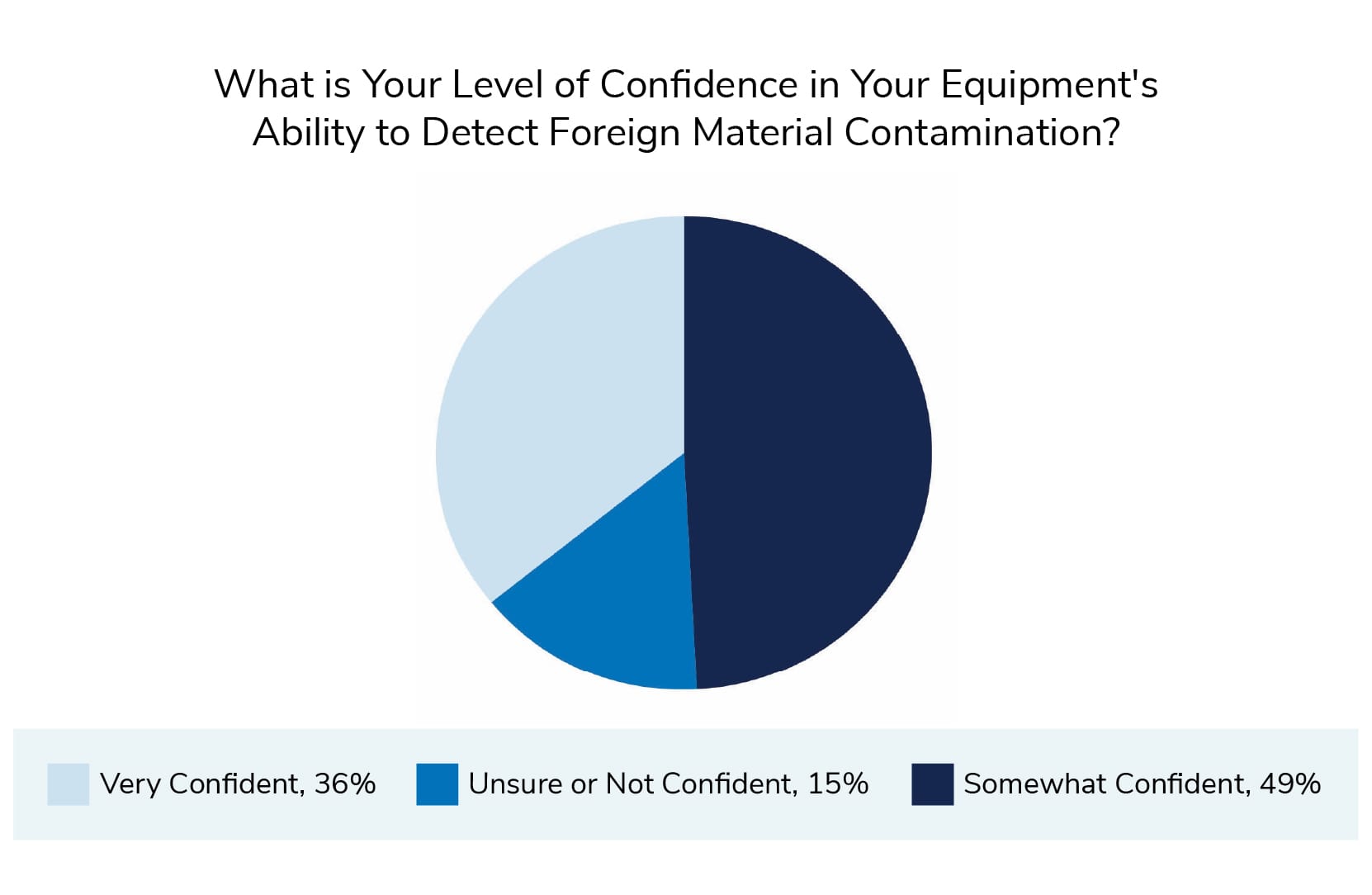

Key Finding Three: Technology Has Never Been Better At Detecting Foreign Material…But Producers Are Still Skeptical

Takeaway:

At 49%, the largest group is those somewhat confident that their technology will detect foreign material. Given the advances in inspection technologies and increasing detection sensitivities, in-line technology remains an area of skepticism for producers.

Further to this point, when asked what types of professional development resources would most benefit our respondents to grow their understanding of the foreign material contamination response process, the overwhelming majority wanted to understand detection technology better. This implies that there is still a gap in understanding the nuances of specific detection tools.

Respondent Demographics

We conducted a survey in February 2024 that was distributed and solicited via email and social media. The respondents represented over 200 industry professionals from 37 U.S. States and 1 Canadian Province. The survey included both FlexXray customers and non-customers.

Frequency of Physical Contamination in Food

Looking at the food and beverage industry as a whole, physical contamination incidents are a relatively frequent event. Our experience working to resolve product holds as a result of these types of incidents informs us that the value of the affected product can vary widely based on the scope of the problem and the value of the product in question.

Frequency, however, is an issue unsurprisingly impacted by industry segment:

Protein producers encounter foreign material contamination significantly more frequently than other categories, with 92% of beef producers surveyed and 85% of poultry producers surveyed encountering physical contamination at least monthly—and more commonly, weekly. This will be relatively unsurprising data to most, as these industries deal extensively with bone as a physical contaminant.

Bone is a uniquely challenging foreign material contaminant. Bone density varies greatly across animal species based on mineral content and structural density variation. Fish is the most difficult, followed by poultry, with beef and pork being much easier to detect due to higher calcification levels.

Inline detection systems vary widely by equipment provider and the type of setup. With no defined standard for protein sources considered indigenous, it is up to food manufacturers to establish thresholds for detection and rejection within their food safety plans. Add to this equation the reality that protein processing is commonly a multi-step, multi-facility process and the risk factors around foreign material in protein grow exponentially.

Also in the high-frequency of contamination set: those making RTE products. This is exactly what one would expect when you combine the automated manufacturing processes of multiple products into a finished product. Producers, particularly those in more processed verticals, often inherit foreign material risk from their supply chain.

For RTE products, the supply chain is generally more varied than nearly any other product vertical. Thus, this segment naturally inherits more risk for its supply chain. With this natural, baked-in risk, the other sources of physical contamination (equipment failure, packaging failure, natural causes, error and sabotage) have a “strong starting point” to enhance the problem further.

There are a few other notable outliers in the industry segments above:

- Packaged Foods:

In this segment, 92% of respondents encounter physical contamination at least once per quarter. This segment is similar to the RTE segment in terms of the diversity of ingredients, often from a range of different suppliers, but it can also encounter issues with packaging that create contamination issues. - Nutraceuticals:

A fast-growing and broadly defined segment, around one-third of this group encounters foreign material monthly, while 27% encounter it every couple of years. This uneven distribution can likely be attributed to the various types of products produced and the methodologies involved in production. - Beverage:

Respondents from the beverage sector encounter foreign material the least frequently of any group. In our experience, these events are typically related to larger components entering the product (e.g., filler tub nozzles) or packaging defects (e.g., improper can seals, glass chips).

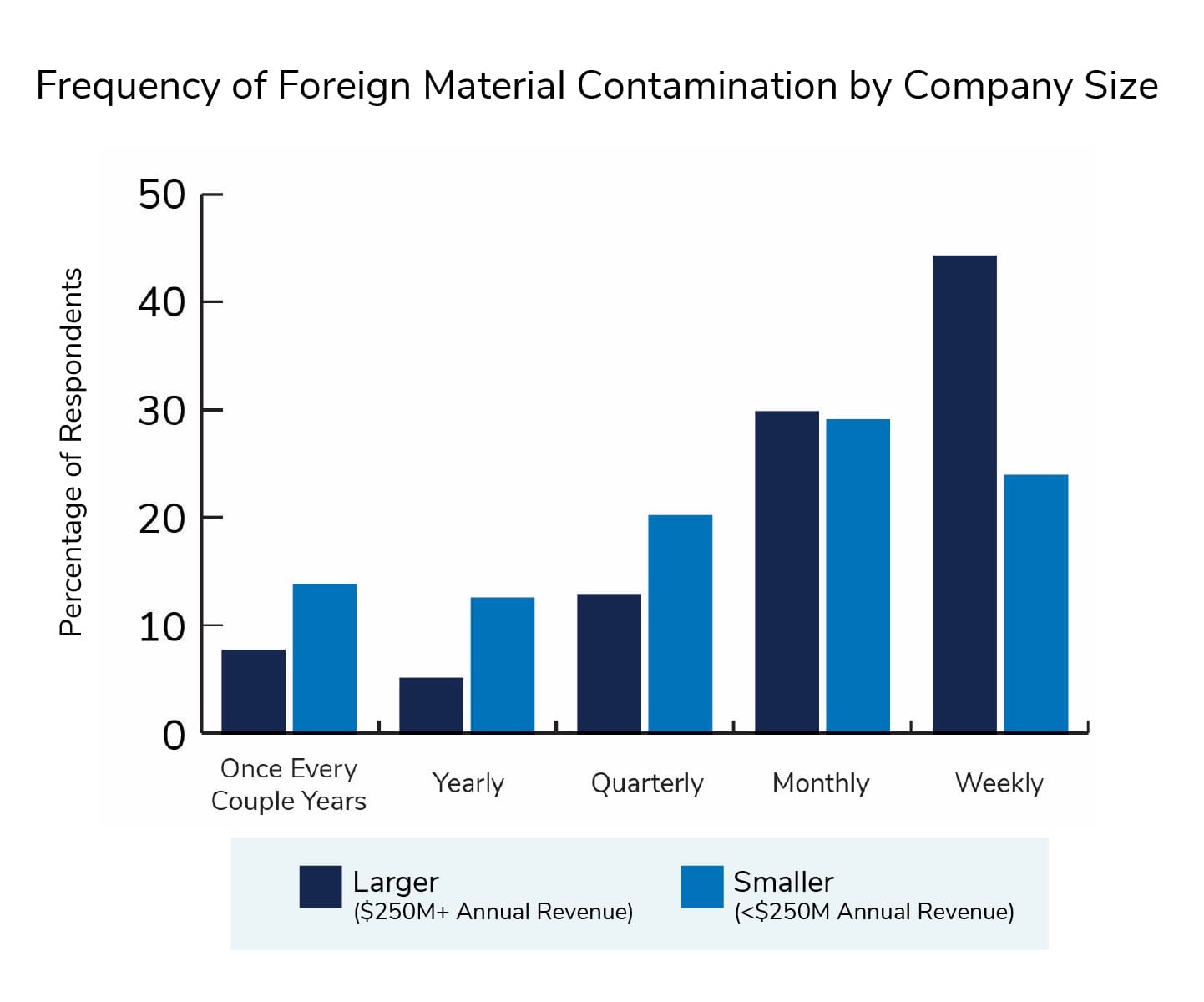

Based on this survey, large food manufacturers encounter foreign material contamination with much higher frequency than their smaller counterparts. There are several possible causes for this trend:

- Larger companies, particularly those in the enterprise level, are often running two to three shifts per day, which increases outputs substantially. In short, the output comparison between these companies is inherently non-linear.

- Automation is also a key component of scaling outputs, which can have a two-fold effect: (1) more automated machinery creates more opportunities for fragments of broken machinery to enter product and (2) more automated inline machinery to detect foreign material contamination.

The gap between these categories is still fairly narrow. Smaller companies are encountering foreign material issues on a more frequent basis (weekly, monthly) than not. This points to scale as the likeliest cause of higher-frequency in larger companies.

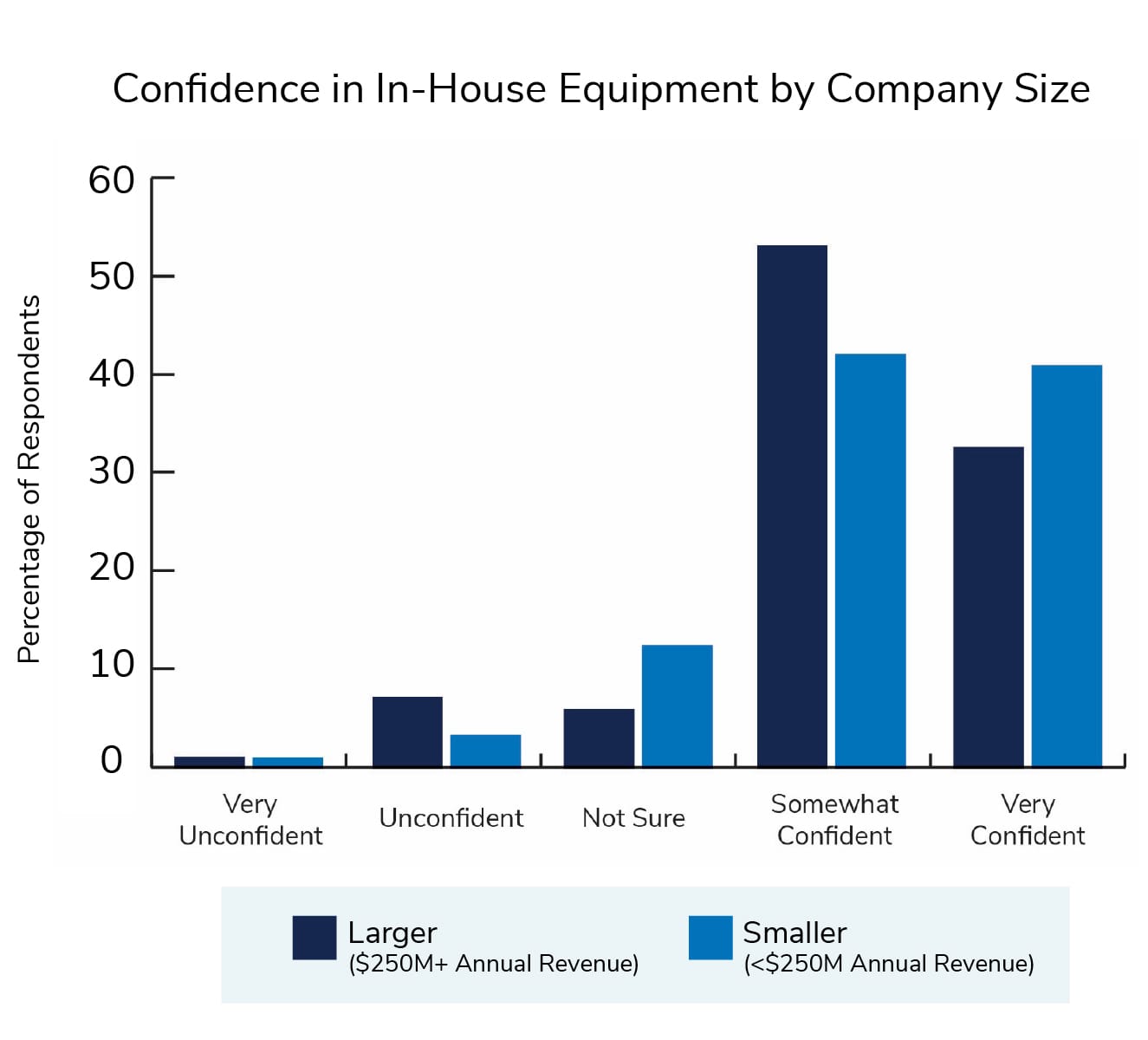

Confidence in In-House Inspection Equipment

The industry at large is more confident than not in its internal equipment, but in a field where error tolerances are low, the majority of producers’ less-than-high confidence in their inline detection equipment is both telling of their experience with foreign material detection—and a reflection of a scientific outlook based in healthy skepticism.

Companies across the revenue spectrum have similar levels of trust in in-house equipment, but smaller companies are slightly more inclined towards greater confidence in their equipment. As this difference is outside the margin of error, one possible conclusion is that the volume produced by larger companies has given FSQA professionals a larger reference frame for foreign material that has gone undetected by inline equipment, thus incrementally reducing their level of confidence.

A key element of this survey asked respondents about their top response to physical contamination. These responses are covered in more detail in the next section, but looking at these options in light of equipment confidence reveals several interesting points:

- Respondents who were “somewhat confident” in their equipment were more than twice as likely to rework product, salvaging what is possible and typically remaking product to backfill production runs.

- Respondents who are “very confident” in their equipment are not necessarily using that equipment to resolve physical contamination incidents, with slightly more respondents using rework as a resolution than reinspection.

Lastly, this benchmark survey revealed that food and beverage producers have a strong desire for better educational resources around equipment:

Nearly two-thirds of respondents wanted to gain a greater understanding of the technology that plays such a huge role in identifying and resolving physical contamination. This represents a significant knowledge gap in the industry around technology used on a daily basis.

Specific areas of focus within this group included:

- Detection Capabilities

- General X-Ray Training

- New Detection Technologies

- In-Plant Technologies

- Metal Detection vs. X-Ray

- Vision Systems in Primary & Secondary Cartons

Want To Plan For Your Next Foreign Material Incident? Contact Us.

FlexXray Insight

One of our respondents’ key questions covered why they had not previously partnered with a third-party inspection company. The second-most common issue cited was about detectability, namely whether or not FlexXray could detect the physical contaminant. This furthers the notion that producers are not as up-to-speed on the technology that drives foreign object detection as they would like to be.

Inline detection technology is highly effective overall, but the most common limiting factor is production speed. In a typical plant environment, inline detection equipment uses a linear diode x-ray for imaging. FlexXray’s technology uses a flat panel detector which, when run at speeds below five feet per minute, allows us to create a robust image with significantly more grayscale and excellent contrast. This allows us to detect physical contamination that inline instrumentation would miss.

Remedies for Physical Contamination

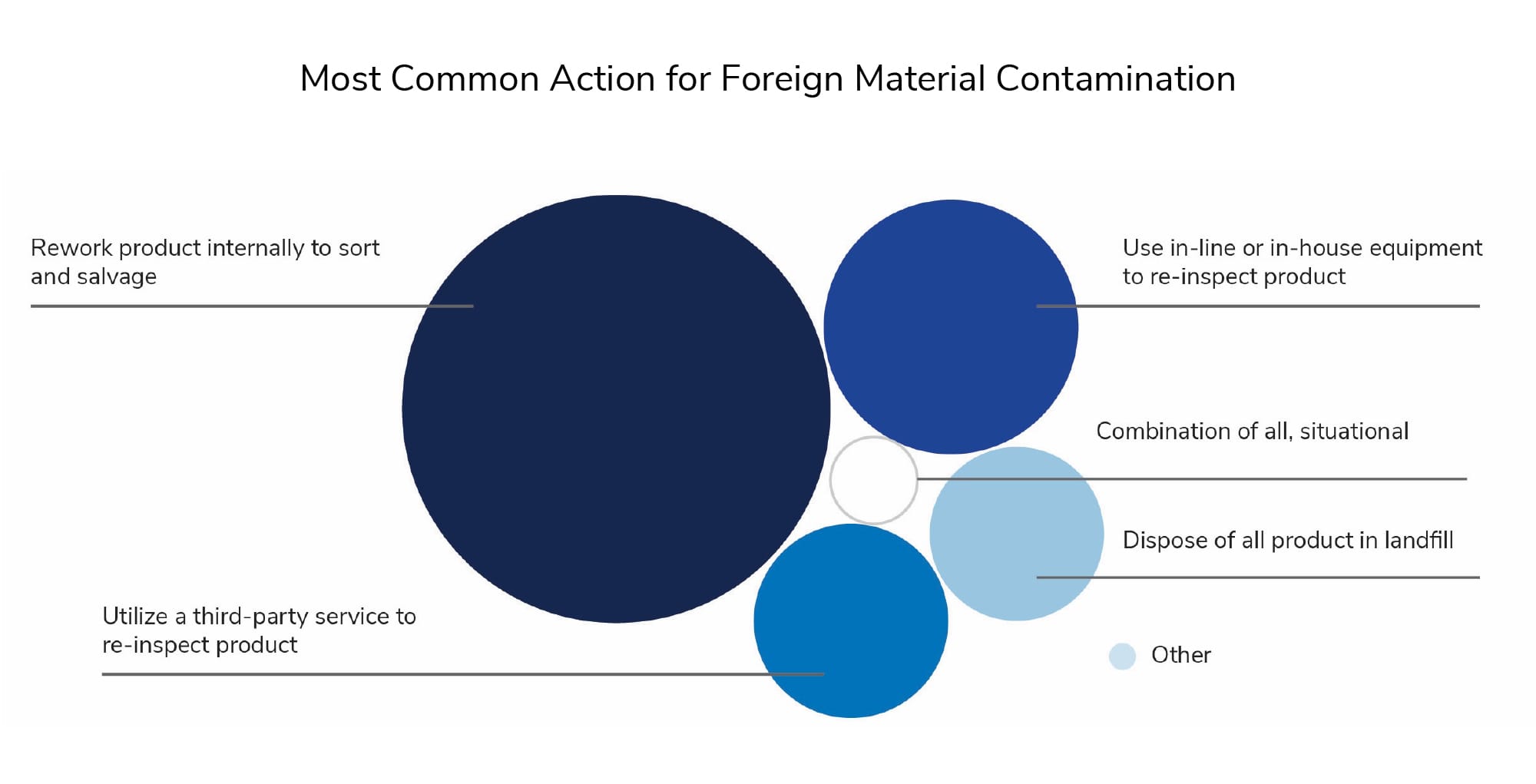

Internal resolution remains the first line of defense for food and beverage manufacturers, with 59% of respondents indicating they utilize one of the two primary methods — rework or re-inspection. It’s important to note for transparency’s sake that FlexXray customers represented nearly two-thirds of all respondents.

This naturally begs the question, “why isn’t third-party inspection more prevalent?” In our experience, the following two scenarios come into play:

- In many situations, physical contamination incidents are limited enough in scope that third-party inspection may not make sense from a cost-benefit perspective.

- In other situations, the value of the product, transportation costs, and inspection costs outweigh the net value of the product.

FlexXray Insight

Third-party inspection will never completely replace internal methods for handling foreign material. There are too many variable and fixed costs involved in determining the overall cost-benefit analysis for third-party X-ray inspection to be the right decision in every situation. However, assessing the true cost of internal remediation is a challenge for food and beverage producers of all sizes.

The top reason a respondent had not partnered with a third-party inspection service was cost-benefit analysis issues. We have written about this topic previously, but the summary of our concerns on this issue is straightforward: we don’t believe producers are counting all of the costs associated with internal resolution.

Our Key Recommendation:

When assessing the cost-benefit analysis of physical contamination, don’t underestimate its actual cost. When you have a significant physical contamination incident at your plant, what you actually have is a supply chain disruption event. There are upstream and downstream consequences, from ingredient shortages to protecting planogram space on store shelves.

Food Safety & Quality Assurance professionals continue to hold the dominant share of decision making power around foreign material contamination product dispositioning. Though this is in line with expectations, the shift away from a collaborative team making decisions is a notable one from the last time we conducted this survey in 2020, when this structure had nearly 25% of the response. This could represent a shift towards FSQA functions having broader command and control over food safety and quality issues.

There are two main items of interest when comparing smaller companies to larger companies on this metric:

- Corporate FSQA has more decision-making authority in larger companies than in-plant FSQA.

- Owners, CEOs and CFOs only get involved in these decisions at smaller companies.

Conclusions

We hope this benchmark report has been insightful and instructive for you. We’d like to close with a few additional thoughts, insights and suggestions based on this report:

- Know Your Equipment

We take growing the understanding of X-ray technology in the industry seriously, and we will post frequently about this topic over the next year. If you have a topic or question that you’d like us to cover, please email our team at research@flexxray.com. You deserve to be confident in the detection capabilities of your equipment. That confidence will help you better understand what your inline equipment can and can’t detect, keeping customers safer from foreign material.

- Know Your Costs

In many cases, internal remediation is the right answer—but certainly not in call cases. When you do a cost-benefit analysis of the various options at your disposal to resolve physical contamination in your product, make sure you’re accounting for all of the costs. If you’re not sure, work with a third-party inspection provider to better understand all of your options before making a decision.

- Know Your Risks & Inspection Options

Different industries face different risks from foreign material. Do you know your highest-risk areas? A proper risk assessment and understanding of what your in-line equipment is set up to find is fundamental to preventing foreign material from making its way to consumers.

About FlexXray

FlexXray was founded in 2001 with a single inspection system. Today, we operate five facilities across the United States and serve 1,100+ food and beverage producers. Since our inception, we’ve used ever-evolving x-ray technology to help our customers find physical foreign material contamination in their product—saving billions of pounds of food from going to landfills and saving over a billion dollars in potentially lost revenue.